It is international Women’s Day and we should be looking for people and things to celebrate. We should also be highlighting inconsistencies in opportunities, like – funding for women’s startups.

Do just one thing? Support more women to start and grow new businesses!

Mike Jenkins, SFL

The British Business Bank reports annually on the small business market through the ‘Small Business Finance Markets 2023/24′ report.

Funding for women’s startups is a significant issue as:

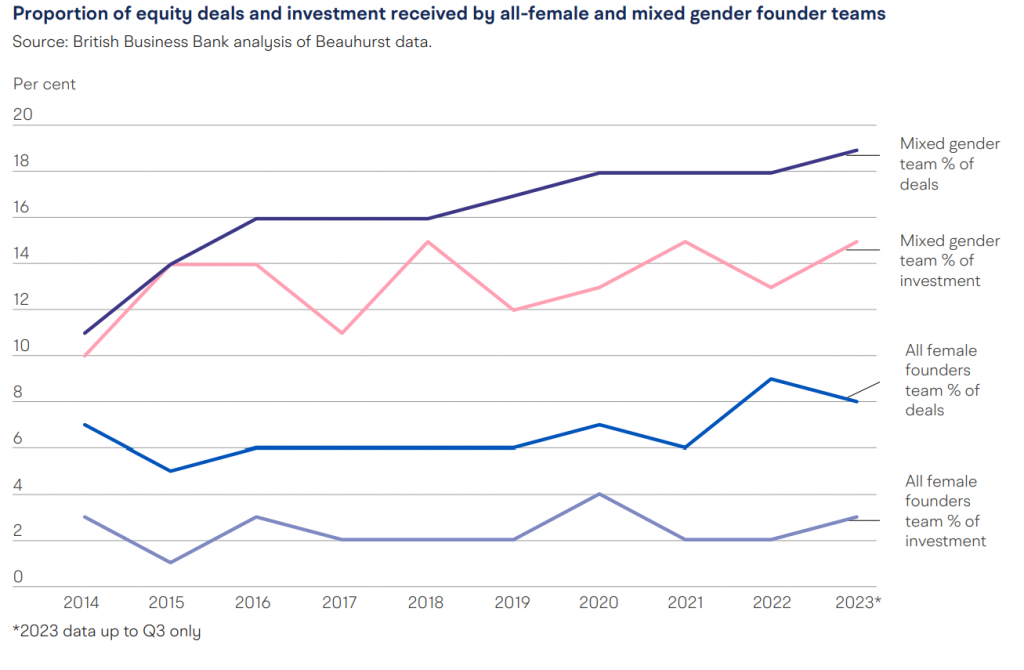

The share of equity investment to teams with at least one female founder has increased by almost 5 percentage points over the past decade, but it still languishes at about 15% of total investment.

The share of the investment received by all female teams remained flat at 3% in 2023, the same figure as at the start of the same period in 2014.

Over the past ten years the UK equity finance market for smaller businesses has experienced a period of significant expansion, enabling thousands of innovative companies to start and scale.

Perhaps related to risks, equity investment into smaller businesses has declined to levels last seen in 2020.

British Busness Bank report – Small Business Finance Markets 2023/24

Gender and ethnicity have a considerable effect on entrepreneurial opportunities and outcomes, with businesses led by female or Ethnic Minority founders having a positive impact on society and the environment. However, the rate of female entrepreneurial activity remains below male activity.

Access to funding and results

Female-led businesses are typically less willing to use finance to grow their business.

Though there may be complex reasons for this, the BBB reports that recently, a significantly higher proportion of female-led businesses have reported needing finance, but not applying.

Application Outcomes – a reason?

Women-led businesses face lower approval rates, as shown by UK Finance analysis of Investing in Women Code (IWC) signatories’ data.

It showed that, 72% of women led businesses that applied obtained debt funding compared to 79% for male-led businesses in 2023.

Also, women-led businesses also obtained lower average facility sizes (£174k compared to £507k for male-led businesses).

Women-led businesses are typically younger and less likely to make a profit. So, information asymmetries may be contributing to the greater difficulties in securing finance.

What can we do in funding for women’s startups?

- Share your experience to help remove inequality in start-ups.

- Encourage those who could benefit from investment to look at all sources.

- Use your network to make the funding sources engage and provide better opportunities for non-male entrepreneurs.

Janthana Kaenprakhamroy, CEO Tapoly is an award winning leader in FinTech. – Reach janthana on LinkedIn

To ensure accuracy, a significant amount of text has been copied from the published annual report. To read the full report search:

British Busness Bank report – Small Business Finance Markets 2023/24 – 2.3 DEI and finance for female, Ethnic Minority and disabled entrepreneurs