Being your own boss today is easier that it’s ever been before. More of us are becoming immersed in the world of freelancing, whether that’s in search of freedom, flexibility, work-life balance or simply to tap into additional income. Side gigs, market places or sharing platforms are making this possible.

What Business Tools Does a Freelancer Need?

Many would say “all you need is a laptop, mobile phone and Wi-Fi”. While these may indeed be the fundamental tools needed to run a business, the actual list of essentials may be even longer. These may include accounting system, client/project management tools, and more. A simple Google search for “essential tools for freelancers” will give you a good list of items that anyone considering a freelancing career will need. However, it’s interesting and rather worrying that very few of those lists include Business Insurance. While we appreciate that there are more exciting things to spend your money on, such as fancy hardware, that hardware will not help you when you’ve got an unhappy client on your case.

Why Should Business Insurance be on Your List of Essential Purchases?

Many people fail to recognise the vital role that business insurance can play in their work. Although for many professions business insurance is not mandatory, having adequate cover in place is an important part of a freelancer’s toolbox. Why? Because as easy as it may sound to be a freelancer, it is still a risky business.

Irrespective of how brilliant you are at what you do, things can and do go wrong from time to time. However diligent you may be in your work, no one is immune from allegations of negligence. Whether you’re dealing with an unhappy client who is claiming loss, or an unpaid invoice, damage to property or a lost mobile phone, it helps to have insurance in place to keep your business going.

What is Professional Indemnity Insurance and What Does it Cover?

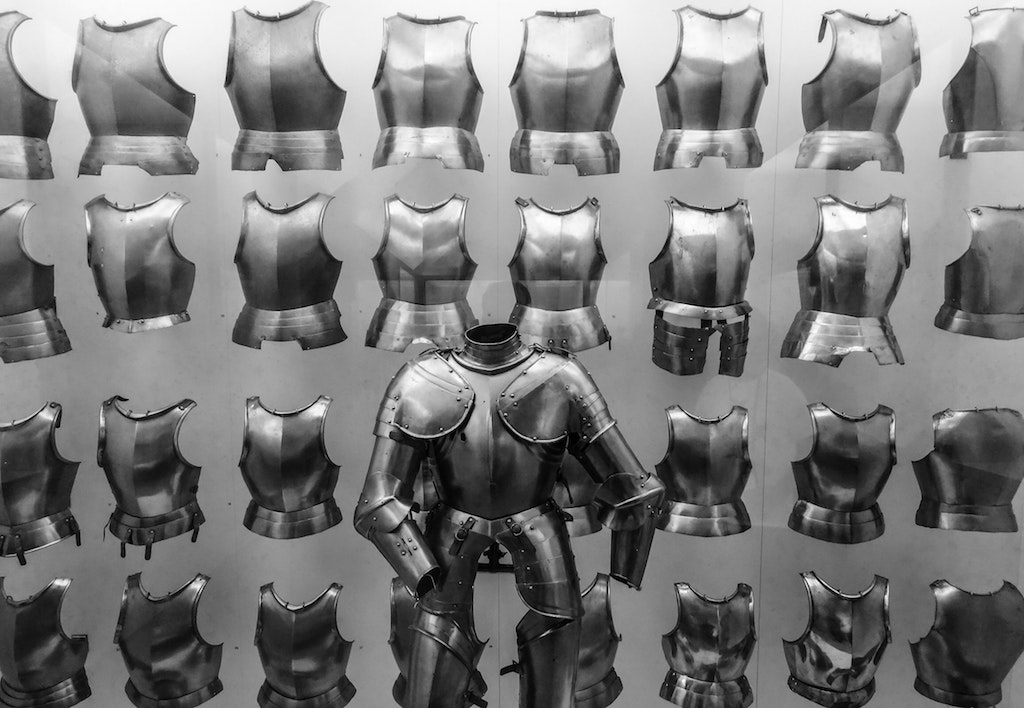

Professional Indemnity (PI) Insurance is commonly purchased by freelancers. PI Insurance protects a freelancer from dissatisfied clients. In situations where a client claims loss of income or damages due to bad advice or services provided by the freelancer, PI Insurance will provide cover. If a claim is made against you, your PI Insurance can ensure that the impact of this on your business and livelihood is minimal. There are bound to be situations where clients see a freelancer as a small, “one-man band” who is unable to fight back, but with PI cover in place the opposite is true. A freelancer who has had the sense to buy Professional Indemnity Insurance essentially has a team of legal experts, solicitors and insurers behind them.

The purpose of Professional Indemnity Insurance is to keep you in business, so think of it as your legal protection. It is also increasingly becoming a contractual requirement imposed by clients, so there is an even greater reason for a freelancer to consider having Professional Indemnity Insurance.

How Can Tapoly Help?

The best part is that Tapoly has made insurance less complicated and less expensive then it used to be. We provide a broad range of on-demand insurance products that are designed specifically for you – freelancers, the self-employed, contractors and SMEs. Our policies are perfect for those people looking for flexibility and easy access without the price tag.

With policies that can be purchased for time periods as short as just 24 hours, for a month, a year or anything in between, and all at a very affordable price, there really is no reason to be exposed to risks any more. The refreshing reality is that with Tapoly you only pay for what you need, when you need it. Insurance doesn’t need to be complicated or expensive.

Find out more about Tapoly Professional Indemnity and check our full list of products and prices.

Can’t find what you are looking for, or have questions, drop us a line at info@tapoly.com.